Good Afternoon,

Today’s issue starts with an awkward realization. The cloud, it turns out, drinks a lot of water. Then crypto decides its future depends on being boring on purpose, and ServiceNow spends $7.75B to make sure every forgotten device finally gets noticed. None of this sounds flashy. All of it matters.

This is one of those editions where the constraints steal the spotlight. Water. Trust. Security. The things markets prefer to treat as background details until they start sending invoices.

ARTIFICIAL INTELLIGENCE

The Cloud Turns Out to Be Mostly Water

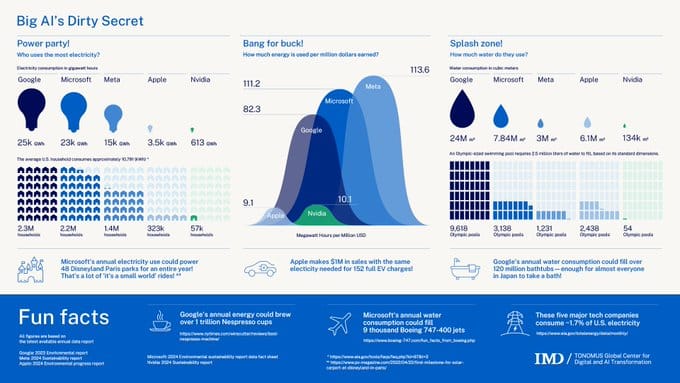

AI infrastructure now uses more water than all bottled water consumed worldwide. This seems hard to believe, but it makes sense when you look at the cooling systems. Chips generate heat constantly. That heat demands cooling. Cooling relies on evaporation. Evaporated water does not politely return.

Why does this matter? Water shortages create real conflicts. Towns compete with data centers. Utilities compete with residents. When AI expands into water stressed regions, resistance forms quickly. Economic enthusiasm struggles against physical scarcity.

How did this happen? AI adoption accelerated without matching infrastructure reform. Compute ran twenty four hours a day. Cooling systems scaled alongside servers. Evaporation stayed the preferred solution because it worked and stayed cheap. Water costs lived outside standard financial reporting.

Energy consumption magnifies the concern. AI already draws electricity comparable to entire nations. Power shortages attract attention. Water shortages attract opposition. Both arrive faster than most forecasts suggest.

Why is nobody eager to advertise this? Environmental disclosures remain fragmented because water creates uncomfortable conversations. Full transparency complicates approvals. Partial transparency preserves momentum. Some firms publish selective sustainability metrics. Others remain conspicuously quiet.

What happens next? Communities demand limits. Regulators respond. New data centers face delays or denials. These outcomes matter just as much as revenue growth. AI profitability depends on physical inputs that refuse to scale indefinitely.

STABLECOINS

Stablecoins Want to Be Boring and That Is the Plan

The crypto industry is pouring money into infrastructure. This investment aims to support a stablecoin economy that could reach $2 trillion. This effort focuses less on price appreciation and more on plumbing. Custody systems, compliance frameworks, transparency layers, and liquidity rails are getting more attention now. This focus is often saved for less exciting but more lasting systems.

Why does this matter? Stablecoins promise something crypto historically struggled to deliver, which is reliability at scale. Payments, settlements, and cross-border transfers work best when users don't overthink them. If stablecoins achieve that level of trust, they could reshape how money moves globally.

How did this push begin? Stablecoins grew faster than the infrastructure supporting them. Early adoption proved demand. Larger institutions then asked for controls, disclosures, and legal clarity. That gap forced the industry to prioritize boring systems over bold narratives.

The opportunity extends beyond crypto native use cases. Fintech firms see stablecoins as faster settlement layers. Payment networks view them as programmable rails. Institutional investors see potential efficiency gains across capital flows.

What stands in the way? Regulation remains uneven across jurisdictions. Counterparty risk still exists. Confidence remains fragile. Infrastructure can reduce these risks, but it cannot erase them entirely.

Emerging markets stand to gain meaningful access improvements. Stablecoins can bypass fragile banking systems and reduce remittance costs. Developed markets face a different pressure. Legacy payment systems look slow by comparison.

What happens if this works? Stablecoins shift from novelty to utility. Liquidity deepens, volatility decreases and the stablecoin market is maturing quietly.

MERGER AND ACQUISITION

ServiceNow Buys a Lock for Every Door It Can Find

image credit: Armis

ServiceNow’s $7.75 billion acquisition of Armis marks its largest deal yet and its clearest statement on cybersecurity. Rather than bolt security onto workflows, ServiceNow chose to buy it outright. The result aims to be a single platform that knows what exists, what is exposed, and what should happen next.

Why does this matter? Enterprises struggle to track assets across hybrid environments. Cloud workloads, connected devices, and operational systems create blind spots. Attackers prefer blind spots. Armis focuses on discovering what companies forgot they owned.

How did we get here? AI adoption expanded network complexity. Connected devices multiplied. Security teams accumulated tools without unifying them. Response slowed as alerts bounced between systems. ServiceNow already managed workflows. Adding asset intelligence closes a loop that previously stayed open.

The integration promises real time discovery tied directly to remediation. Vulnerabilities receive context. Workflows trigger automatically. That combination appeals to large organizations managing critical infrastructure.

Why did Armis choose this path? An IPO offered independence. An acquisition offers scale. Joining ServiceNow embeds Armis capabilities inside enterprise operations rather than selling them as an add on.

Some investors questioned the price. Others focused on long term positioning. Cybersecurity spending rarely shrinks. Attack surfaces rarely simplify.

What does this signal broadly? Enterprise software firms increasingly absorb security rather than partner loosely. Consolidation accelerates. Platforms win over point solutions.

If this integration succeeds, ServiceNow becomes harder to displace. Security becomes part of everyday operations and that is usually where budgets follow.

NEWS

Anything else on the burner?

Novo Nordisk ended its worst year since 1984 with shares down 40%. FDA approval of oral semaglutide flipped sentiment, lifting stock 8%. A $149 monthly starter price targets cash payers, beats Lilly to shelves, and reframes obesity economics as pills promise scale, margins, and steadier demand in 2026 forecasts ahead.

Silver cleared $70 per ounce after rising 140% in 2025, while gold hit $4,480 and copper topped $12,000 a ton. Structural supply gaps plus AI, EV, and solar demand turned precious metals into industrial balance sheet assets. Silver miners followed, with some stocks up over 300%, making hedges look fashionable again.

After smashing the public markets with a 371% surge, Starfighters Space Inc. (FJET) saw shares drop over 50% as investors caught their breath. The mood shift highlights volatility risk when speculative aerospace valuations meet real world capital needs.

RVPH shares dropped roughly 50% when the FDA demanded a second pivotal trial for its lead schizophrenia drug. The company must raise at least $60 million for the next phase, turning prior hopes into dilution-risk calculations for shareholders.

MEME OF THE DAY

Oh Holidays…..

Takeaway

Together these updates paint a picture of an economy that is moving forward with careful confidence and the occasional identity crisis. Rate policy is shifting, tech giants are rewriting their playbooks, and financial firms are testing blockchain like a new kitchen gadget they hope will justify the receipt. Nothing is spinning out of control, at least not visibly, which tends to be the moment worth paying attention to. See you tomorrow, assuming nobody tokenizes another asset before sunrise.