THE WEEK AHEAD

Welcome to the week ahead.

It opens with a billionaire writing a $40.4 billion personal IOU, a holiday calendar pretending to rest, and markets quietly deciding which days still count as business hours. Larry Ellison turned a merger filing into a confidence exercise, consumers keep shopping out of habit rather than joy, and economic data arrives compressed into a few high-stress mornings.

This is one of those weeks where very little happens loudly and quite a lot happens anyway.

Think of it as a short schedule with ambitious intentions and just enough volatility to keep everyone checking their phones between leftovers on Christmas.

MERGER AND ACQUSITION

Ellison Writes the Biggest IOU Hollywood Ever Saw

Larry Ellison made a bold move by personally guaranteeing $40.4 billion to back Paramount Skydance’s bid for Warner Bros Discovery. This shows that cash often speaks louder than words. The announcement arrived without ceremony, spectacle, or cinematic build up. It showed up as a filing and a promise backed by serious balance sheet confidence. The offer stays at $30 per share, all cash. It now comes with strong billionaire reassurance.

Paramount paired the guarantee with additional structural commitment. The reverse termination fee rose to $5.8 billion. Also, the tender deadline changed to January 21, 2026. Ellison also agreed to leave family trust assets untouched until the transaction concludes. This combination reads less like theater and more like accounting discipline. The message feels clear enough for shareholders who prefer certainty over suspense.

Markets responded in the expected, understated way. Warner Bros shares moved modestly higher. Paramount shares climbed more decisively. In merger language, that suggests financing doubts lost relevance very quickly. A large content library combined with guaranteed liquidity tends to sharpen investor attention. Confidence often improves when funding shifts from hypothetical to personal.

The broader story remains unresolved. Antitrust review is still coming, along with public and regulatory scrutiny. This often targets large media combinations. Shareholders need to compare a sure cash exit with the possible futures offered by different visions. For now, the guarantee converted background chatter into a headline moment. The next phase will show if consolidation gets praise or faces a long review.

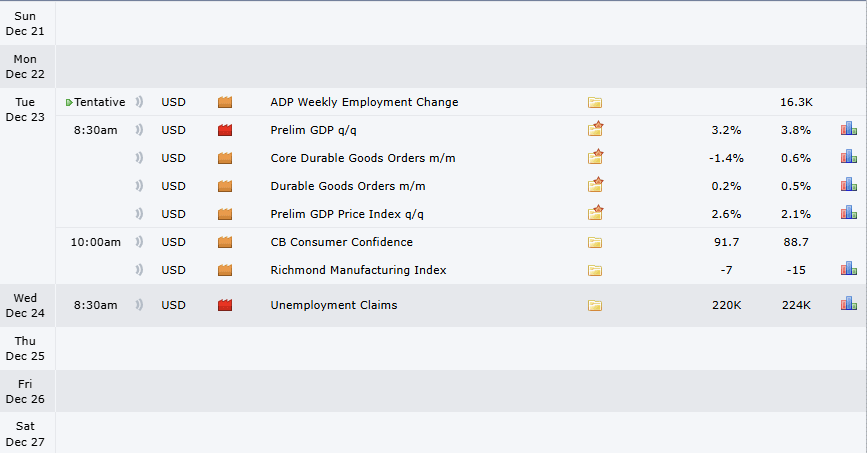

ECONOMIC CALENDAR

A Modest Calendar with Ambitious Intention

This week’s economic schedule prefers concentration over sprawl. Most important data comes in a short time frame. So, Tuesday is the unofficial main event. Markets will spend the start of the week forming opinions. Then, they will spend the end of the week explaining their reactions.

Preliminary GDP figures headline the calendar, offering an updated read on growth momentum. Alongside GDP, durable goods orders provide insight into business investment appetite. Core orders strip out transportation noise, which makes them less exciting but far more useful. The GDP price index adds another inflation check without igniting policy panic.

Consumer confidence comes out midmorning. It often affects sentiment, even when the basics suggest otherwise. Confidence readings reveal expectations more than actual behavior. This is why markets pay close attention to them. Richmond manufacturing data wraps up the session. It offers a regional view that either supports or contrasts with national trends.

Wednesday’s unemployment claims data follows, continuing its role as the market’s preferred weekly reality check. The number itself isn’t shocking, but its direction tells a story about the labor market. It shows whether the market is cooling or staying strong. That narrative often travels further than the data itself.

The rest of the week is quiet. This can make reactions to earlier releases stronger. With fewer competing headlines, traders tend to revisit the same figures repeatedly. Holiday timing further reduces noise, giving economic data more room to influence sentiment than usual.

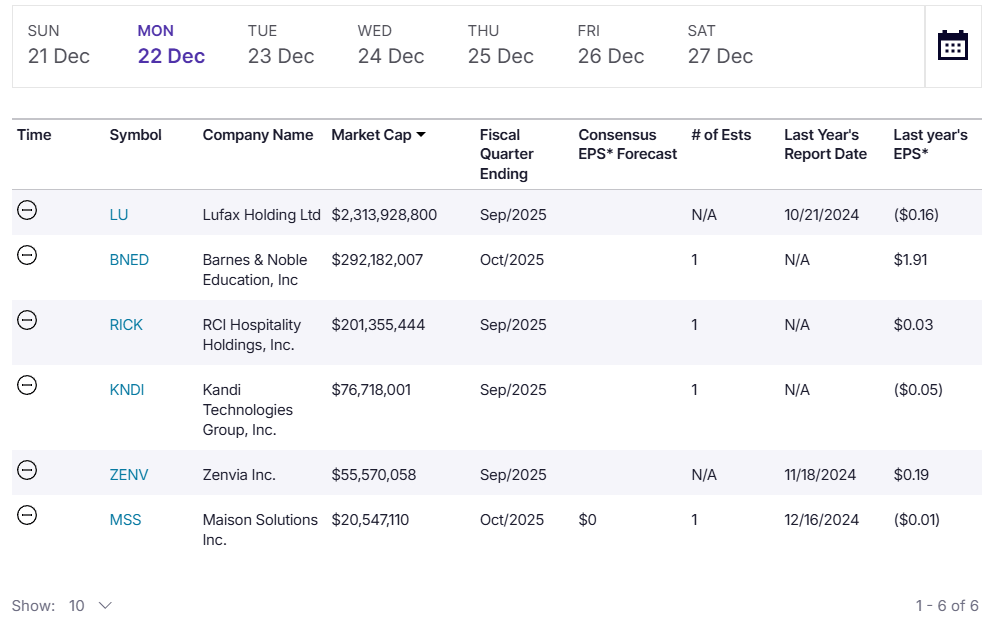

CALENDAR FOR THE WEEK

Your Week Ahead, Lightly Frosted and Overbook

It’s that time of the year once again.

Christmas week arrives with no intention of slowing down. Shopping activity remains elevated, even after the wrapping paper settles. Nearly 159 million people were expected to shop over the final weekend before Christmas, and about 70% plan to continue hunting for deals afterward. Retail calendars remain optimistic. Consumer confidence remains less so.

Sentiment fell to its lowest level since April, reminding everyone that spending and happiness rarely peak together. Updated consumer confidence data arrives tomorrow, offering fresh insight into how cheerful shoppers feel once the credit card notifications arrive.

Here is what the rest of the week looks like:

Updated consumer confidence data releases tomorrow

The delayed initial Q3 GDP estimate finally publishes tomorrow

Powerball advertises a jackpot near $1.6 billion tonight

Festivus arrives tomorrow, grievances encouraged and expected

Entertainment fills the remaining hours. Netflix hosts its second straight Christmas NFL doubleheader, pairing Commanders versus Cowboys and Vikings versus Lions. Musical performances join the broadcast, because multitasking applies to holidays now. Prime Video adds Broncos versus Chiefs for viewers collecting subscriptions. Netflix also releases additional Stranger Things episodes later this week.

Movie theaters make a coordinated push on Thursday, with multiple releases spanning prestige drama, nostalgia, and musical storytelling. Africa Cup of Nations matches continue through January, quietly anchoring the global sports calendar while everything else rotates.

NEWS

Anything else on the burner?

Prediction markets exploded as DraftKings, Coinbase, Robinhood, FanDuel, and Fanatics rush in. Monthly volume jumped from under $100 million in early 2024 to $13 billion by November. Robinhood calls it fastest growing. Shares climbed 200% in 2025. Federally regulated reach now spans 50 states. Lawyers circle as platforms monetize curiosity at scale.

Tesla’s 2018 compensation gamble paid off after a 7 year court battle restoring Elon Musk’s $140B award and reinforcing shareholder votes as decisive currency in executive pay disputes for boards

After the Brown-MIT shooting suspect emerged from the green card lottery, the Trump administration paused the DV visa program that grants about 50,000 visas per year. Markets in immigrant labour and remittance-fueled sectors may now face unexpected headwinds.

In support of its Warner Bros acquisition, Netflix refinanced part of its $59 billion bridge loan, replacing it with a $5 billion credit line and two $10 billion term loans, leaving about $34 billion yet to syndicate. The tweak helps stabilize Netflix’s balance sheet as the $82.7 billion takeover looms.

Trian and General Catalyst swooped in to buy Janus Henderson for $7.4 billion cash, offering $49 per share. The deal rewards long-suffering investors with an 18% bump and signals consolidation in asset-management as public money pours into private hands.

MEME OF THE DAY

Its been more than a year since this kid became the meme.

Takeaway

Together these updates paint a picture of an economy that is moving forward with careful confidence and the occasional identity crisis. Rate policy is shifting, tech giants are rewriting their playbooks, and financial firms are testing blockchain like a new kitchen gadget they hope will justify the receipt. Nothing is spinning out of control, at least not visibly, which tends to be the moment worth paying attention to. See you tomorrow, assuming nobody tokenizes another asset before sunrise.