This Week in Boardrooms, Bots, and Federal Guesswork

Another week, another pile of billion-dollar decisions made by people wearing Patagonia vests indoors. Paramount crashed a merger like someone bringing a wedding gift to a divorce. Apple’s executive team started vanishing like your AirPods in couch cushions. Nvidia might invest $14B in robot brains that still can't fold laundry. And the Fed is prepping for its big performance part policy meeting, part improv night.

If you like your business news with a side of chaos and a sprinkle of existential dread, you’re in the right place.

MERGER AND ACQUISITION

Paramount Crashes the Party With a $108B Knock‑Knock

David Ellison, head of Paramount Skydance, seen leaving after a media chat inside the New York Stock Exchange.

Just when Netflix thought it had the party favors, Paramount Skydance showed up waving a check for $108.4 billion and asked, “Is this the after‑show?” Paramount threw down an all‑cash, $30‑per‑share hostile bid for Warner Bros. Discovery. They claim it beats Netflix’s offer by about $18 billion and comes with fewer strings attached or at least fewer stock‑and‑debt dangling promises.

Paramount insists this isn’t a cheap cash grab. They pitch it as a bid to revive old Hollywood: cable, streaming, and theaters all under one roof. The company argues that merging Warner’s studios, streaming, and cable networks with Paramount+ would drive competition, bring movies back to theaters, and give studios and audiences a new dose of ambition.

But the drama isn’t over. Warner’s board had already accepted Netflix’s bid and Paramount says that decision ignored its prior offers. With regulators, shareholders, and possibly courts now getting involved, this fight could stretch into a multi‑season saga of mergers, lawsuits, and popcorn‑ready chaos.

MERGER AND ACQUISITION

Nvidia Looking to Bet $14B on Silicone and Hope

SoftBank and Nvidia are reportedly circling Skild AI, a robotics software startup, with a possible investment at a $14B valuation. That's a billion with a B, for a company that doesn’t make robots it makes the software that tells robots how to think. The kind of thinking that lets them grab a box without flinging it across the room.

Skild focuses on training general-purpose AI brains for robots. Not kitchen-friendly humanoids just yet, but the kind of logic that might make future bots less clumsy and slightly more useful. Investors seem to believe that whoever builds the Windows of robotics wins the decade. For now, Skild is building that operating system just with fewer spreadsheets and more limb coordination.

The market has clearly decided that “robot intelligence” is the next frontier, even if the robots still struggle with stairs. If the deal goes through, SoftBank and Nvidia will be backing a bet that someday, machines will not only learn but maybe also stop breaking things on the job.

TECHNOLOGY

Apple's Midlife Crisis Has a C-Suite Problem

Apple’s leadership is starting to look like a group chat where everyone suddenly leaves without saying goodbye. In one week, four of Tim Cook’s direct reports announced their exits. Two are retiring. One is joining Meta. And the head of AI, John Giannandrea, is reportedly stepping away, presumably after Siri failed another simple request.

An identity crisis paired with massive talent drain is hitting the company. Apple’s AI efforts have lagged behind, and the people responsible are leaving the building. Researchers are defecting to OpenAI, Meta, and startups that at least pretend to have working chatbots. Even Johny Srouji, the man behind Apple’s in-house chips, is reportedly considering a new challenge. Possibly one where he doesn’t have to explain Siri’s performance to shareholders.

Tim Cook just turned 65 and says he’s staying. The problem is, some of his most important chefs are hanging up their aprons. Apple still has cash, brand power, and a loyal user base. What it needs now is someone to make Siri useful and maybe stop Bieber from offering product feedback.

US ECONOMICS CALENDAR

The Fed, the Jobs, and the Drama

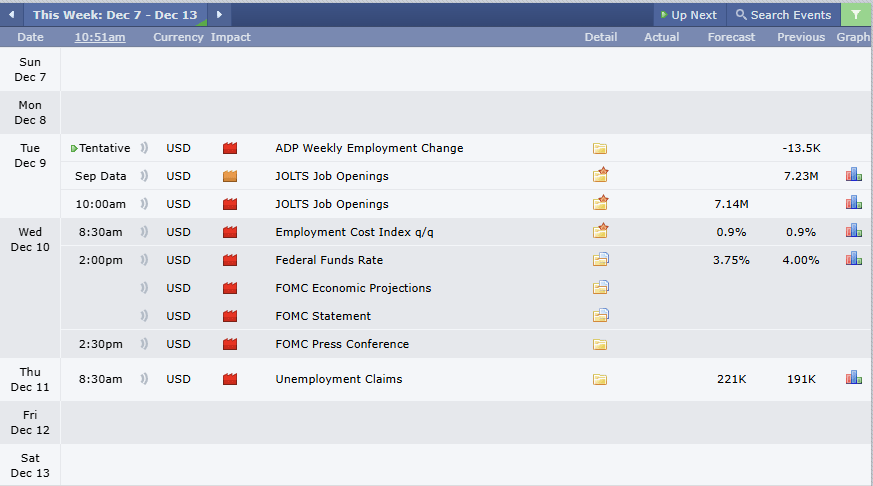

The Federal Reserve meets this week, and everyone’s pretending they don’t already know what’s coming. Markets are pricing in a third consecutive rate cut, but expect at least one policymaker to remind everyone they can read inflation charts too. The post-shutdown data backlog makes things murky, so the Fed’s call on Wednesday will be less about clarity and more about vibes.

On the data front, we’ll see JOLTS job openings, the Employment Cost Index, and unemployment claims. In other words, a perfect mix for economists to argue about labor “softness” without agreeing on what that actually means. ADP already kicked things off by estimating a 13.5K decline, which might just be noise or the start of something messier.

All eyes will be on Wednesday’s Fed decision and the press conference that follows. Rate cut? Probably. Unity among policymakers? Unlikely. A fresh round of market hopium based on Jerome Powell’s tone? Almost guaranteed. Buckle up for what may be the most polite financial disagreement of the quarter.

MEME OF THE DAY

Bear Market Vibes?

Takeaway

So that’s your week ahead, Paramount wants to revive Hollywood by buying the plot, Apple’s C-suite is testing the emergency exits, and the Fed is preparing to cut rates because... reasons. Meanwhile, Nvidia and SoftBank continue their quest to make robots smarter, one VC pitch at a time.

Check back tomorrow to see if Warner Bros. accepts the second marriage proposal, if Siri learns how to pronounce Giannandrea, and if Powell can cut rates without cutting investor enthusiasm. Or don’t. Your phone will probably notify you anyway.