Welcome back.

The market has entered that strange stretch where volume disappears but confidence refuses to leave. Stocks hover near records, silver steals attention, and seasonal optimism starts checking the calendar for backup. Everything feels calm, which is usually when traders get suspicious.

Today’s issue covers what is quietly doing the work, what is being politely ignored, and which assumptions are hoping the new year cooperates.

MARKETS

The Santa Rally Clock Starts Ticking

Merry Christmas

U.S. stocks hovered near record levels in a thin post Christmas session, with futures subdued and volume looking like it took a personal day. The major indexes stayed green without much drama, which is usually when traders start getting nervous. Investors kept leaning on a familiar idea: lower rates next year plus earnings that keep showing up. For a market, that is basically comfort food.

📊 What is doing the heavy lifting here?

Rate cut expectations and a steady earnings outlook remain the core support, even when the tape feels sleepy. The market is treating 2026 like a report card year, which is polite phrasing for pressure.

Dow up about 0.02% during the session

S&P 500 up about 0.14% during the session

Nasdaq up about 0.17% during the session

S&P 500 near 7,000 as traders watch the level

🧮 What part of this is sustainable?

The optimism leans heavily on corporate margins proving that big tech spending has a payoff. Analysts see S&P 500 profit growth around 15.5% in 2026, which sets a high bar with a very public deadline. If results land short, the market has a talent for losing patience quickly. Thin trading can hide that impatience until volume returns.

🎯 Which part is wishful thinking?

The Santa Claus rally window is in play, and traders love seasonal patterns when they already like the chart. The risk is that low liquidity turns small surprises into larger moves than anyone planned for. A quiet session can still deliver an uninvited headline. The calm can feel friendly right up until it stops.

⏰ How long can this last?

If 2026 becomes a prove it year, price levels will need real earnings follow through. The market has already priced in a smooth handoff from hype to productivity. That is an ambitious plan for an asset class that also believes in vibes.

COMMODOTIES

Silver Joins The End Of Year Drama

Silver pushed into fresh record territory during thin post Christmas trading, and the move drew attention fast. The rally reflects a mix of industrial demand and investor positioning that has been building for months. When a metal starts acting like a headline, portfolios tend to listen. Year end liquidity makes every move look a little louder.

🪙 Who wins if this works?

Silver is pulling demand from two directions at once, with industry treating it as an input and investors treating it as protection. That combination can keep momentum going even when the tape looks quiet. It also invites crowded positioning, which rarely stays polite for long.

Spot silver hit $75 per ounce for the first time

Session high reached $75.14 before easing

Price later traded around $74.46

Gold hovered near $2,100 per ounce during the same session

📉 What could go sideways next?

Year end trading conditions can exaggerate swings, which turns normal profit taking into something that looks dramatic. The rally has also been fast enough to tempt short term chasing. That is great for headlines and tougher for risk management. Silver has a habit of reminding traders that it enjoys volatility.

🏦 Who is holding the risk, politely?

If rate cut expectations stay firm into 2026, metals can keep catching bids as real yields cool. If policy expectations shift, the unwind can be quick. Investors enjoy certainty, and silver enjoys testing it.

🔍 What are we pretending about?

A metal tied to factories and fear can stay supported longer than people expect. The market is pricing a future where demand stays strong and hedging stays fashionable. That is a confident assumption for a calendar that still has plenty of room.

STOCK MARKET

When Stock Performance Outpaces Business Results

Intel’s 2025 rally put the company back on the scoreboard and reminded investors that turnarounds still trade. The stock gained over 80% during the year, supported by major capital commitments and a clearer manufacturing strategy. Momentum feels great, and it also creates expectations that show up every quarter. Intel now carries a bigger spotlight and a tighter timeline.

🏦 Who is holding the risk, politely? Intel’s financing stack looks stronger after a wave of outside backing that includes an $8.9 billion U.S. government equity investment plus $2.2 billion in prior grants. Nvidia also committed $5 billion in equity priced at $23.28 per share, and SoftBank added $2 billion priced at $23 per share. Those numbers buy time and signal intent. They also make missed milestones louder.

📊 What is doing the heavy lifting here? The market is leaning hard on the foundry narrative, because that is where scale could reshape margins. Recent results showed Intel’s foundry segment losing $2.3 billion on $4.2 billion in quarterly revenue, which highlights progress and ongoing pressure. A narrowing loss tells a better story than a widening one. Investors still want the point where the segment pays rent.

🧮 What part of this is sustainable? Intel’s plan includes $18 billion in gross capital expenditures for 2025 and operating expense targets of $17 billion in 2025 and $16 billion in 2026. That spending profile can work if utilization rises and mix improves. It gets awkward if customer wins remain slow. Factories enjoy scale, and balance sheets enjoy cash flow.

🎲 What happens when demand blinks? Foundry success relies on outside customers signing up for long cycles, and those customers tend to move carefully. If external demand scales, Intel earns operating leverage and valuation support. If demand stays limited, the stock will keep telling a hopeful story while the income statement stays stubborn.

NEWS

Anything else on the burner?

Silver is now traded several ways: over-the-counter in vaults, futures on COMEX and Shanghai, ETFs backed by vault silver, physical bars and coins, or via mining-company stocks That flexibility turns silver from dusty bullion into liquid asset with leveraged optionality.

Markets are closing 2025 on a high note as the S&P 500 nears 7,000 for the first time. Broad gains across sectors suggest the rally isn’t built on one trend but a mix of optimism, rate-cut hopes, and year-end momentum.

Fundraisers on GoFundMe rose 17% in 2025 as Americans increasingly crowdsource rent, groceries and utility bills. The surge reflects affordability pressure as living-cost stress gets packaged as social-media appeals instead of corporate earnings disclaimers.

Atos agreed to sell its Latin American operations to Semantix, handing off ~2,800 employees across six countries. The deal underlines Atos’s post-restructuring push to shed non-core assets and rework its debt-laden balance sheet.

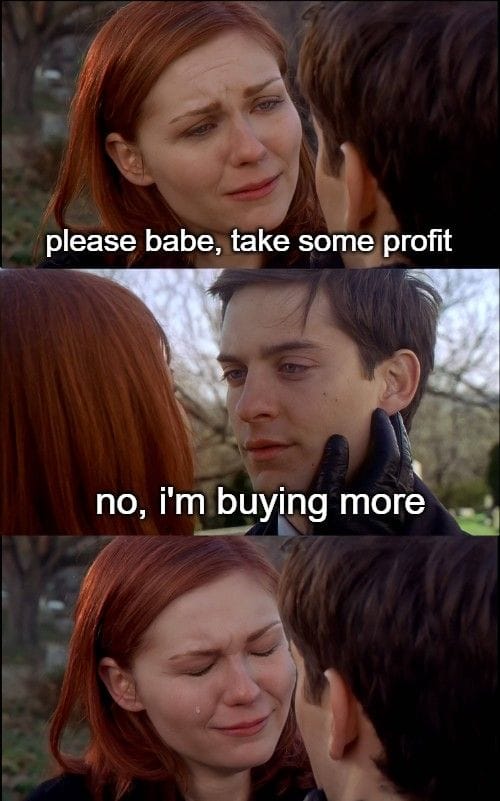

MEME OF THE DAY

Holiday Shopping

Takeaway

Taken together, today’s stories share a familiar rhythm. Prices are moving faster than certainty, optimism leans on timing, and thin liquidity keeps magnifying small decisions. Stocks believe in earnings, silver believes in drama, and Intel believes patience will be rewarded eventually. Stay tuned for the next issue!