CONSUMER

US Consumers Dropped $11.8B on Black Friday

Adobe Analytics says American shoppers spent $11.8B online this Black Friday season this is according to Reuters. That’s more than the GDP of Slovakia, and probably half of it was people panic-buying air fryers they already own.

The most popular spend categories? Electronics, apparel, and "Buy Now Pay Later" debt. Orders using BNPL jumped 42% YoY. Consumers are buying new TVs the same way they buy used cars: $0 down and deep denial.

Retailers leaned on steep discounts and free shipping gimmicks to push sales up, but underlying inflation means margins are thinner than ever. For many stores, the real Black Friday might be the one in their balance sheets.

JOB MARKET

Layoffs Are Spiking, But Everything Is Fine (Allegedly)

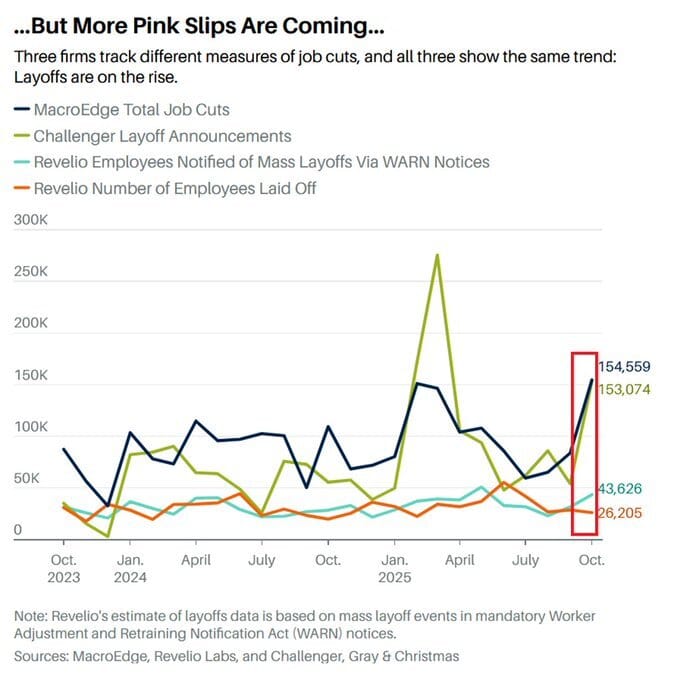

Alternative data firms are reporting a layoff surge across the US economy. MacroEdge says job cuts in October rose to 154,559, a 70K+ jump from the month before. Challenger Gray puts it at 153K, the highest October tally in 22 years.

At the same time, WARN notices tracked by Revelio hit 43,626, the second-highest count in at least two years. Tech, retail, and finance led the pack, as companies quietly prep their "we’re-rightsizing-to-stay-agile" press releases.

If you’re wondering how this fits into the whole "strong labor market" narrative: it doesn’t. But it does explain why LinkedIn feels like a job fair at a tech funeral.

AI AND TECHNOLOGY

AI Is Taking Jobs and the Excuse Is “Productivity”

52% of US workers now fear losing their job to AI, up from 27% last year. That number doesn’t include the ones who already got the Slack message that starts with “Hey… quick Zoom?”

Big tech claims AI helps employees focus on "higher value" work. Meanwhile, the Fed and MIT say AI is already replacing humans in tech, customer service, and creative work. MIT's Iceberg Index found AI can replace 11.7% of the labor market, or $1.2 trillion in wages.

CFOs are split: 42% say the best way to prove AI ROI is headcount reduction. 43% call that a bad idea. The remaining 15% are probably still asking ChatGPT to write their earnings calls.

Most companies now offer AI training. Less than half make it mandatory, which tells you how seriously they take the whole "we’ll retrain everyone" talking point.

CREDIT MARKET

The Stars Are Aligning (Just Not for You)

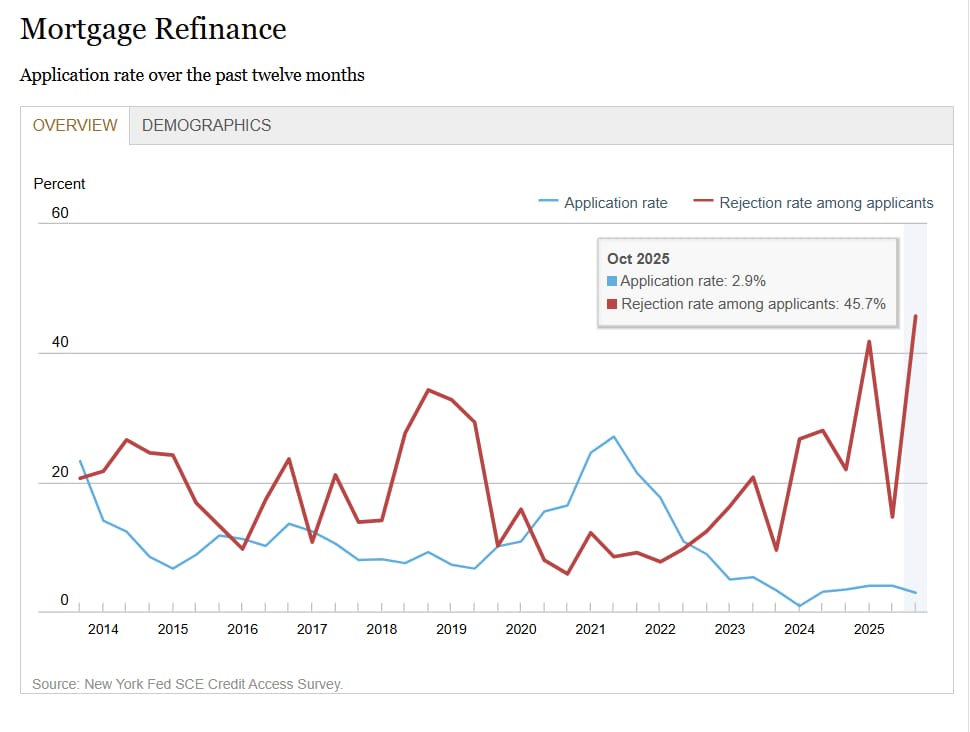

As if mass layoffs and AI-fueled job anxiety weren’t enough, credit is now harder to get than a raise during a hiring freeze. The New York Fed says 24.8% of US credit applications were rejected in the past year, the highest rate since they started tracking this back in 2014.

Let’s break that down:

Mortgage refinance rejections? 45.7% a record high

New mortgage rejections? 23% highest since 2015

Auto loan rejections? 15.2% second highest ever

Credit card rejections? Holding steady at a cool 21.2%

Translation: You might lose your job to AI, and also get declined for the loan you needed to pretend everything’s fine.

Access to credit is tightening across the board, which is kind of poetic if you’re into economic doom loops. Less income, fewer approvals, more stress spending on Black Friday. It’s all lining up like constellations except this horoscope ends with “you may be entitled to financial compensation.

MERGER AND ACQUISITION

Warner Bros Might Be Getting a New Plot Twist

The studio behind HBO, CNN, and a confusing amount of streaming rebrands confirmed it’s considering buyout offers. Executives reportedly started shopping for a deal back in October, and now the plot’s thickening.

Netflix just entered the chat with a mostly cash offer to buy Warner Bros Discovery for $72B, according to Reuters. Paramount-Skydance and Comcast also threw their hats in, making this less of a quiet sale and more of a full-on Hollywood bidding war.

WBD already turned down a near-$24/share offer, so it’s clearly holding out for something with a better box office. The deal could hand Netflix access to legacy IP like Harry Potter, DC, and CNN’s 2 AM reruns, assuming regulators don’t treat it like a crossover episode nobody asked for.

For now, investors are treating it like a pilot worth greenlighting. Shares have been catching a bid, and this is one sequel Wall Street actually wants to see.

MEME OF THE DAY

NEWS

Anything else on the burner?

Zuck logs out of the metaverse to face reality

Crypto found another trillion lying around, apparently

Gold might be limbering up again after investors briefly headed for the exits, according to KobeissiLetter

MrBeast launching a FinTech? Sure, what’s one more thing to monetize

CNBC signs deal to borrow confidence from Kalshi traders

Amazon may break up with USPS, and it’s starting its own delivery drama

Takeaway

In case you lost count:

Layoffs are rising

AI is taking your job

Credit is disappearing

Consumers are still spending like it’s stimulus season

And Warner Bros is flirting with Netflix like it’s a prestige drama pitch

Basically, the economy is a sitcom with horror pacing. Everyone’s pretending things are fine, even as half the cast gets written off, the set catches fire, and the laugh track won’t stop playing.

If you’re still employed, with access to credit, and haven’t impulse-bought a second air fryer this week, congratulations you’re one of the lucky extras who made it to Season 2.