Good to have you here.

Today’s issue opens with a small existential crisis for oil. When silver costs more than crude oil, the markets have a message. They’re speaking quietly, without caring about tradition. We then see robots that shine on spreadsheets but seem costly in real life. Next, Alphabet buys more concrete so its algorithms have a place to operate.

None of this is dramatic in isolation. It serves as a reminder that the economy keeps changing, and it doesn’t ask for permission. Old inputs lose relevance. New bottlenecks appear. And capital keeps migrating toward whatever feels scarce next.

METALS AND ENERGY

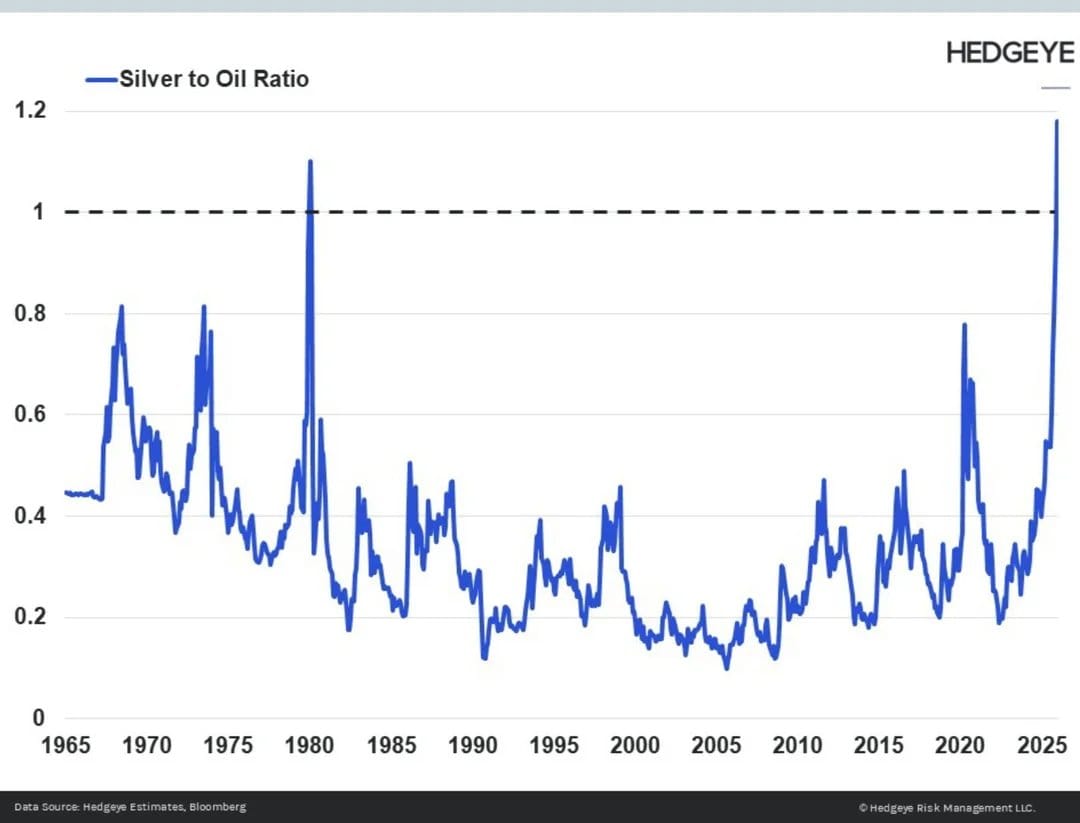

When an Ounce Beats a Barrel

An ounce of silver costs more than a barrel of oil. This may seem like trivia, but it helps explain behavior. Silver trades near $32 per ounce while oil sits around $56.59 per barrel. This ratio last showed up during the pandemic crash. That adds some historical discomfort to the current moment.

How did this happen? Oil demand weakened across multiple fronts. Fewer miles driven, cautious consumer spending, and slower industrial activity reduced consumption. China’s rapid electric vehicle adoption accelerated this trend, directly impacting global oil demand. Demand destruction rarely announces itself loudly. It usually arrives through steady erosion.

Oil prices dropped roughly 21 percent year to date

Global driving patterns softened rather than rebounded

Efficiency gains reduced incremental fuel consumption

Silver moved in the opposite direction. Industrial demand expanded quietly but persistently. Solar panels require silver for conductivity. Electric vehicles rely on silver intensive components. AI data centers increased demand through electronics and power systems. These uses stack rather than rotate.

This marks the fifth consecutive year of silver shortage

Mining output struggles to scale fast enough

Recycling remains insufficient to close the gap

There is also a financial layer. Silver attracts hedging demand as countries reduce exposure to dollar denominated assets. That demand reinforces industrial pressure rather than replacing it. The result feels less speculative and more infrastructural.

Will this ratio last forever? Probably not. Either oil rebounds when economic activity strengthens, or silver corrects when enthusiasm cools. What stands out now is the message. Markets appear to price fossil fuel demand as tired while pricing metals for new infrastructure as scarce. That transition rarely feels smooth when viewed in real time.

ROBOTICS

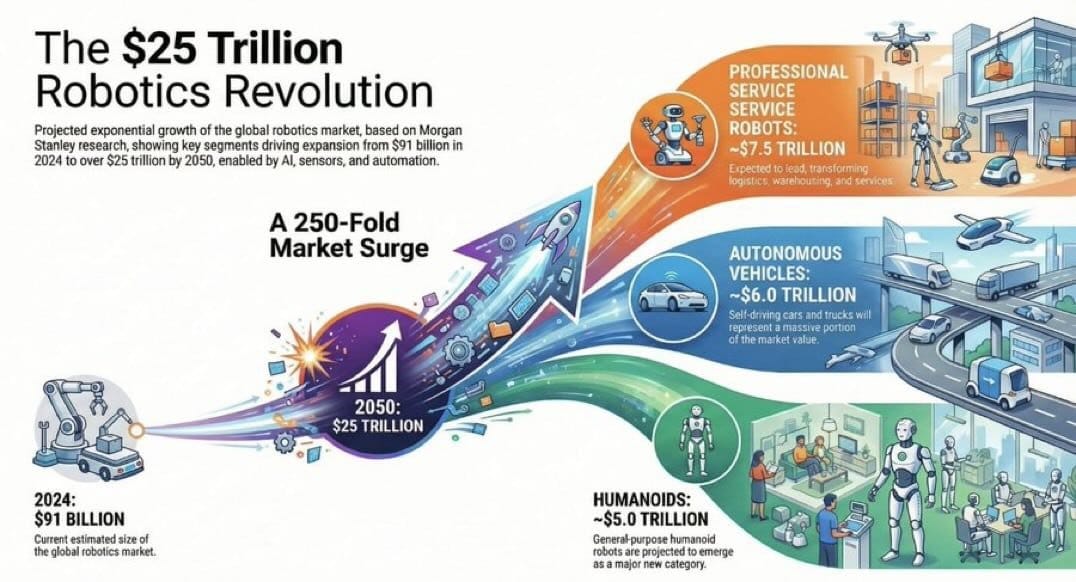

Robots Are Expensive When They Actually Have to Work According to Morgan Stanley

Morgan Stanley predicts that robotics will grow into a $25 trillion industry by 2050. Humanoid robots and robotaxis will lead the way in revenue. The math takes the global workforce and multiplies it by expected productivity. This approach works well in a spreadsheet. Real environments tend to be less cooperative.

Why does this projection matter? It assumes artificial intelligence agents work reliably at scale. Current testing suggests otherwise. AI agents fail a large share of tasks even in controlled conditions. Humanoid robots operating in factories, offices, or homes would face constant unpredictability.

AI agents still fail most complex task chains

Reliability matters more than raw intelligence

Scale magnifies failure faster than progress

Which companies actually have robots? Tesla, Meta, Alphabet, and Nvidia were cited as having foundational technologies. Tesla remains the only US public company showing humanoid prototypes. Elon Musk suggested robots could generate $30 trillion in annual revenue, a figure larger than today’s entire US economy. The ambition is clear. The math deserves scrutiny.

What about supply constraints? The forecast assumes lidar demand grows three hundred fold and rare earth usage rises nearly five hundred fold.

Memory shortages already affect consumer electronics

AI data centers absorb supply aggressively

Robotics scaling worsens existing bottlenecks

Until AI works consistently, this market remains more promising than production.

MERGER AND ACQUISITION

Alphabet Buys More Concrete for Its Algorithms

Alphabet will spend about $4.75 billion to buy Intersect, a data center firm. This may seem dull, but that’s the idea. As artificial intelligence workloads expand, the constraint is no longer clever software alone. It is land, power, cooling, and square footage that can survive continuous demand. Intersect focuses on large-scale data center development. This makes it a great fit for companies training ever-hungrier models.

Why does this matter now? Cloud providers face mounting pressure to secure reliable capacity. AI model training and inference use a lot of computing power. Renting space now seems wasteful. Owning infrastructure offers more control, fewer surprises, and longer planning horizons. Alphabet appears willing to trade short term margin optics for long term certainty.

The acquisition also reflects a broader competitive shift. Cloud competition now revolves around who controls the physical layer of computing. Power availability, where it’s located, and how quickly it can be set up are just as important as how well the software works. Owning infrastructure cuts reliance on third parties. This way, you won’t face delays from those who focus on other customers or restrict growth when demand is high.

From an investor perspective, the deal reads as strategically defensive. Capital expenditures rise, returns arrive later, and patience becomes required. Analysts often describe infrastructure as unglamorous until shortages appear. Alphabet seems intent on avoiding those shortages rather than explaining them later.

This purchase reinforces a larger theme. AI competition increasingly resembles industrial competition. The winners secure inputs early, even when they look expensive. Algorithms still matter. Concrete and electricity now matter almost as much.

NEWS

Anything else on the burner?

Mercedes-Benz agreed to a $1.5 billion diesel emissions settlement, trading prolonged litigation for a single invoice, funding cleanup programs, consumer payouts, and reminding automakers that regulatory risk carries compound interest.

European investment banks met tariff volatility with caution, missing trading upside as clients sat tight. U.S. rivals took flow, proving scale and balance sheets monetize chaos better than headlines alone.

US GDP grew at a 4.3% annualized clip in Q3 2025 fueled by strong consumer spending and business investment making economists nod and CFOs pat their balance-sheets with relief.

Faced with unclear timing from the Supreme Court on tariff refunds, firms like Kids2 are monetizing claims for cents on the dollar in “special situations” trades This converts potential windfalls into modest up-front cash while handing future upside to investors

Samsung Electronics unit Harman is paying $1.76 billion to acquire ZF’s ADAS unit capturing radar, smart-camera and computing tech tied to driver assistance. The deal signals Samsung’s move from chips and phones into car brains as connected vehicles race to replace auto parts.

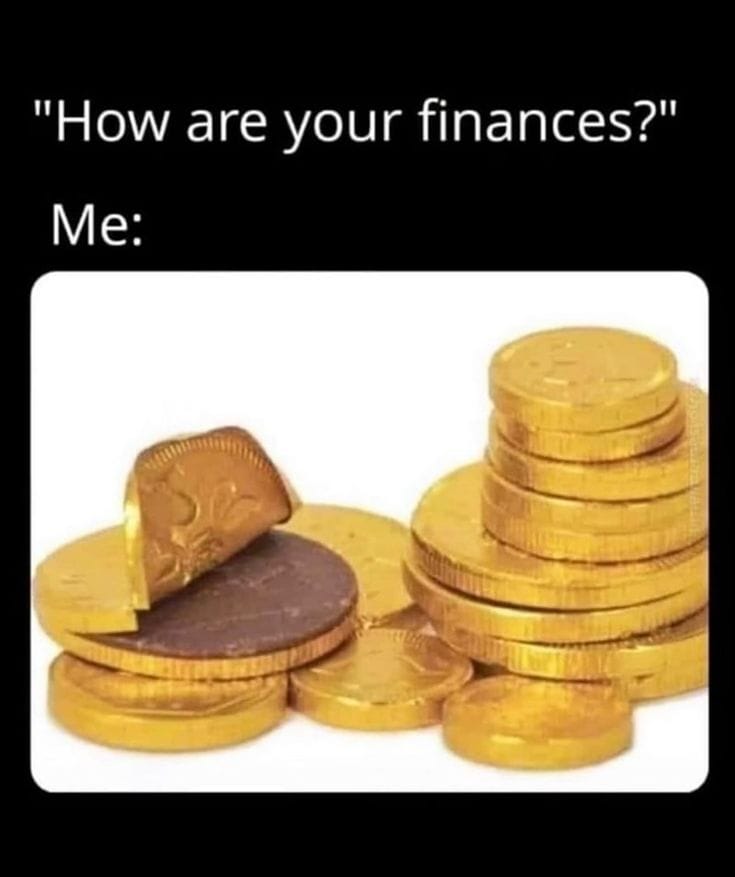

MEME OF THE DAY

Merry Christmas

Takeaway

Stepping back, the common thread today is constraint. Oil struggles with demand. Silver strains under industrial pressure. Robotics dreams bump into reliability and supply limits. AI leaders see that electricity and square footage are almost as important as code.

Even the side notes reinforce the point. Settlements replace lawsuits. Banks struggle to monetize volatility. Growth looks strong, but only in certain areas. Capital keeps flowing toward certainty, infrastructure, and assets that age well under stress.

Markets are adjusting, without making a scene. We will keep tracking where the pressure builds next, long before it becomes obvious.