Ambani’s “Free” Bet Didn’t Look Like a Strategy Until It Was

In 2016, Mukesh Ambani announced that Jio, his new telecom startup, would offer four months of completely free mobile service. Unlimited 4G data. Free voice calls. No roaming charges. Premium apps included.

On the surface, it looked like a marketing stunt. In practice, it was a carefully engineered strike. Ambani had already poured $25B into building India’s most advanced telecom infrastructure. Jio quietly connected 200,000 villages and 18,000 cities. Meanwhile, other operators were still reviewing tower-sharing spreadsheets. By the time competitors noticed, their lunch was already gone.

India Had Trust Issues With Data Plans

Lines wrapped around Jio stores. Supplies ran thin. Within a month, over 16M users had joined. By the third month, that number hit 50M.

This was pent-up frustration finally finding a working SIM card. For years, Indian consumers paid $2–3 per GB for inconsistent speeds and surprise billing. Jio gave them stable service and zero friction without any throttling.

The Real Shock Was What Came Next

Most expected Jio to reel things back once the free trial ended. Maybe introduce a loyalty plan. A light upsell.

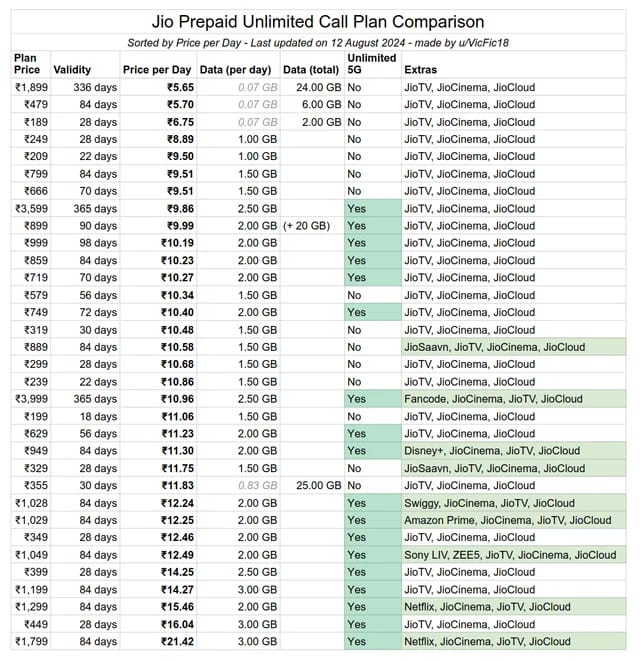

Instead, Jio introduced permanent pricing that immediately broke the industry:

$0.60 per GB

Free voice calls nationwide.

Access to Jio’s full suite of apps is included.

It wasn’t a promotional hook. It was the new standard, and it came fully backed by infrastructure, spectrum, and patience.

Competitors Scrambled and Still Fell Behind

Airtel launched Project Leap, a $9B upgrade effort. Vodafone started bundling Netflix and Amazon Prime. Idea pitched affordable phones under EMI plans. Everyone did something.

Timing mattered but the execution mattered more.

Jio’s advantage wasn’t clever packaging. It had better coverage, cheaper delivery, and full control over the content layer. Where others partnered with streaming platforms, Jio owned the platform. Jio provided internet that stayed strong during cricket finals, while others just gave cashback.

The market didn’t just shift. It flipped. Vodafone and Idea merged in a defensive Hail Mary. Tata exited. Aircel collapsed. Within two years, the operator count fell from 10 to 4. It looked less like competition and more like a fire sale.

When ARPU Dropped, So Did the Margin for Error

Airtel’s average revenue per user dropped from ₹196 ($2.35) to ₹123 ($1.47) within two years. Vodafone and Idea reported similar drops.

In telecom, ARPU is like oxygen. Drop it 35% and every decision becomes a budget conversation. Network expansions stall. Product rollouts get delayed. PR budgets suddenly disappear. That wasn’t a side effect of Jio, it was the plan.

The SIM Card Was Just the Onboarding Funnel

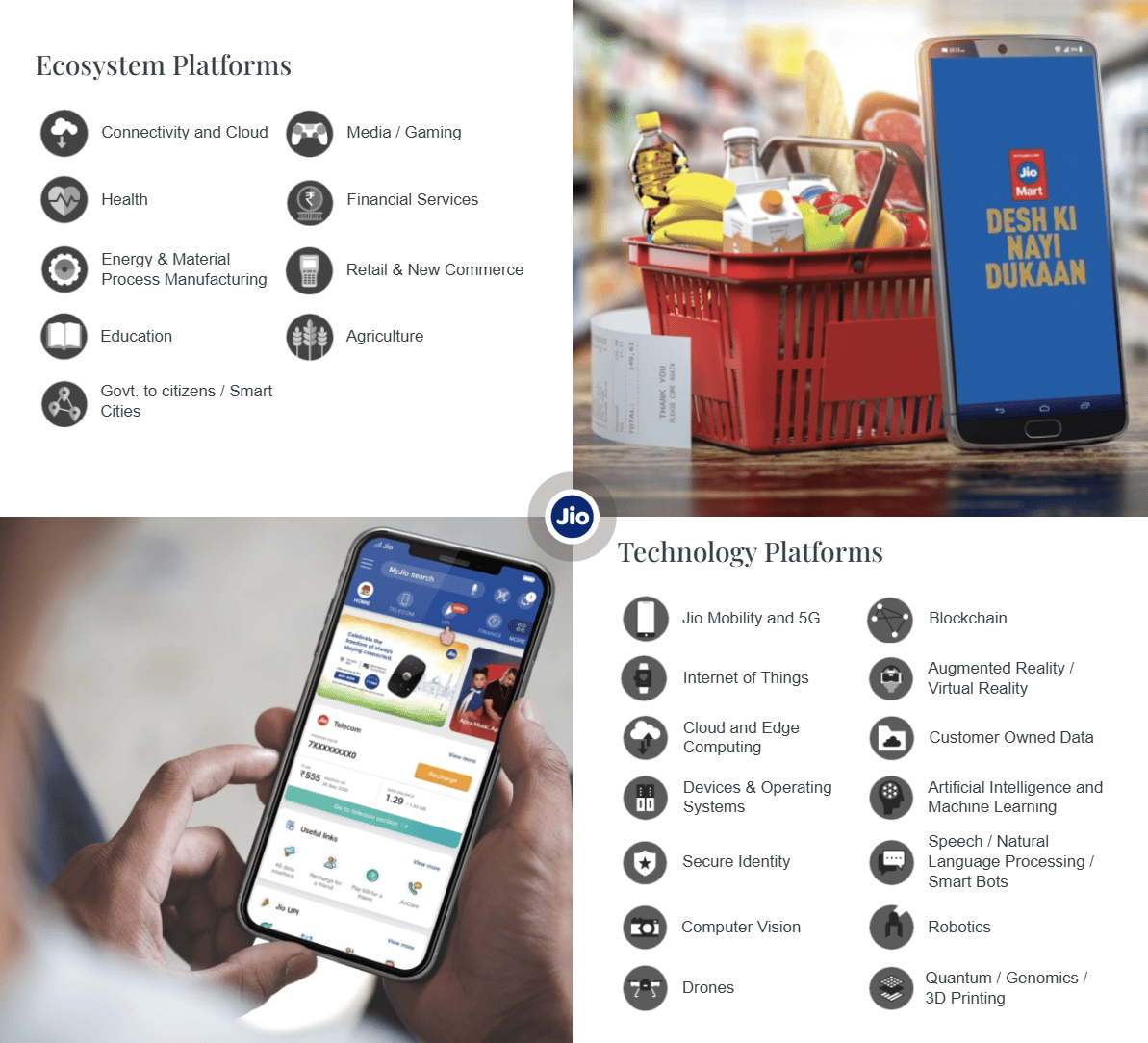

The free SIM wasn’t the product. It was the lead magnet. Once users came in, Jio expanded sideways into everything:

JioMart for groceries

JioCinema for streaming

JioPay for transactions

JioHealth for remote checkups

JioCloud for storage (and forwarding your uncle’s PDFs)

Each service was built in-house, ran on Jio’s infrastructure, and reduced the odds of churn. No contract needed. Just frictionless convenience.

Customers didn’t notice how deep they were until it was too late. They had already paid their electric bill through Jio and watched three episodes of a show they never meant to start.

Signal Beat Slogans

While others spent time on ads, jingles, and touching “connection” stories, Jio focused on keeping users online during peak hours.

When your network stays strong during a family video call or a live cricket match, people are more likely to stay no matter who's singing in your ad.

Discounts Were the Least Interesting Part

Jio didn’t just offer cheaper data. It offered a cheaper ecosystem it fully owned.

They measured success differently. While others focused on minutes and megabytes, they looked at app usage, transaction volume, and screen time. It wasn’t monetizing traffic it was monetizing behavior.

That’s how you turn a SIM card into a distribution channel.

The Broader Impact

Jio now holds over 40% of India’s mobile market. But that number understates what actually changed.

Since its launch, data prices dropped 90%. Internet access in rural India jumped from 33% to over 70%. Digital payments exploded. Online video became mainstream. Education platforms, health services, and small businesses started running through phones.

And it wasn’t just growth, it was infrastructure-driven growth.

Jio turned bandwidth into a utility. Then it built the retail layer on top. Investing early and building before pricing changed everything. Also, integrating everything from towers to touchscreens made a big impact. Not with slogans. With execution.

Free service was the headline, but infrastructure was the real strategy. That’s what changed Indian telecom.