TECHNOLOGY

Google Built a Chip That Made Nvidia Drop $250B

GOOGL vs NVDA Chart: 30% Difference since November 1, 2025

Google and Amazon didn’t call a press conference. Without any invites or prior announcements, they just opened the back door, built custom silicon, and left Nvidia watching from the parking lot.

Google’s new TPU, Ironwood, is tailored for large-scale AI work. It’s designed to train and deploy models without asking Nvidia for permission or pricing. As soon as this hit the tape, Nvidia shed $250B in market value. No speech. No blame. Just gravity.

For a while, Nvidia was the only supplier at the party. Now the hosts are making their own snacks, building their own ovens, and locking the kitchen.

INVESTING SENTIMENT

Wall Street Loads the Leverage Cannon

The only thing lifting harder than this market is its own expectations (yes).

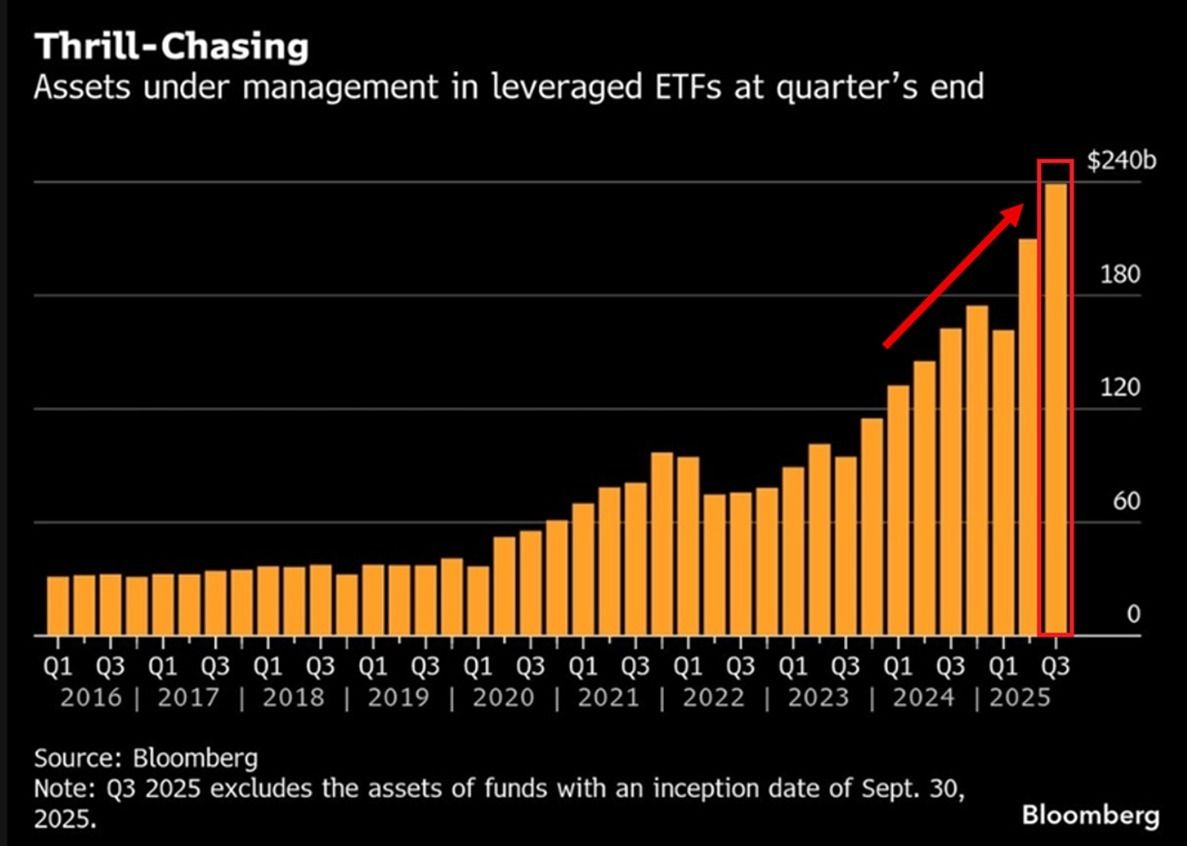

Leveraged ETF assets in the U.S. hit $239B in Q3 2025. That’s two quarters of full-send inflows. Since 2023, the total has tripled, which says everything you need to know about where traders feel the action lives.

Meanwhile, 0DTE options make up 60% of S&P 500 volume. These contracts expire same-day, which means every decision feels like a race against the closing bell. There’s no long game here. Just velocity, exposure, and maybe a little bit of panic clicking.

If the strategy sounds reckless, that's because it is.

STOCK MARKET

The S&P 500 Is a Group Project and 10 Names Did All the Work

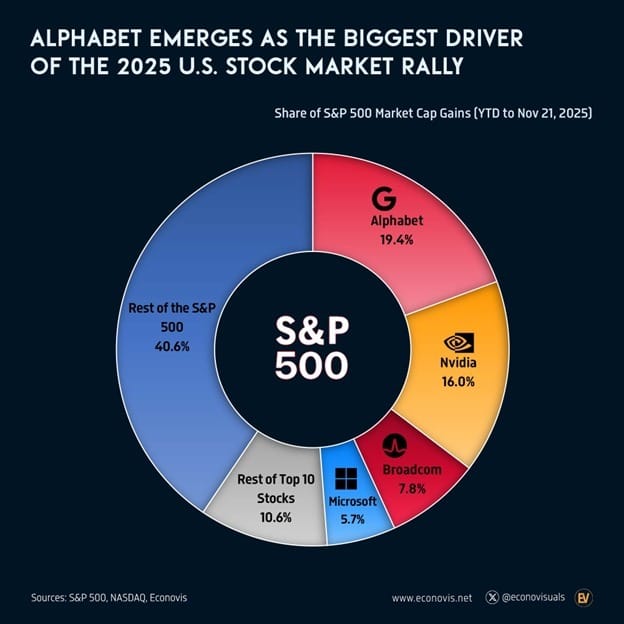

Ever wondered how the S&P 500 is up 40% YTD after a 20% drop last April?

Alphabet added $1.3T in market cap. Nvidia brought $1.05T. Broadcom and Microsoft handed in $900B combined. The math writes itself. These four names moved more than entire sectors.

Together, the top 10 stocks generated 59.4% of the index’s 2025 gain. That means the remaining 490 names made up 40.6% a participation trophy at scale. Essentially a popularity contest disguised as a broad rally. And the cool kids brought liquidity.

In practice, index investing feels like buying a tech-heavy portfolio with extra packaging.

STOCK MARKET

Hedge Funds Treated the Dip Like a Black Friday Flash Sale

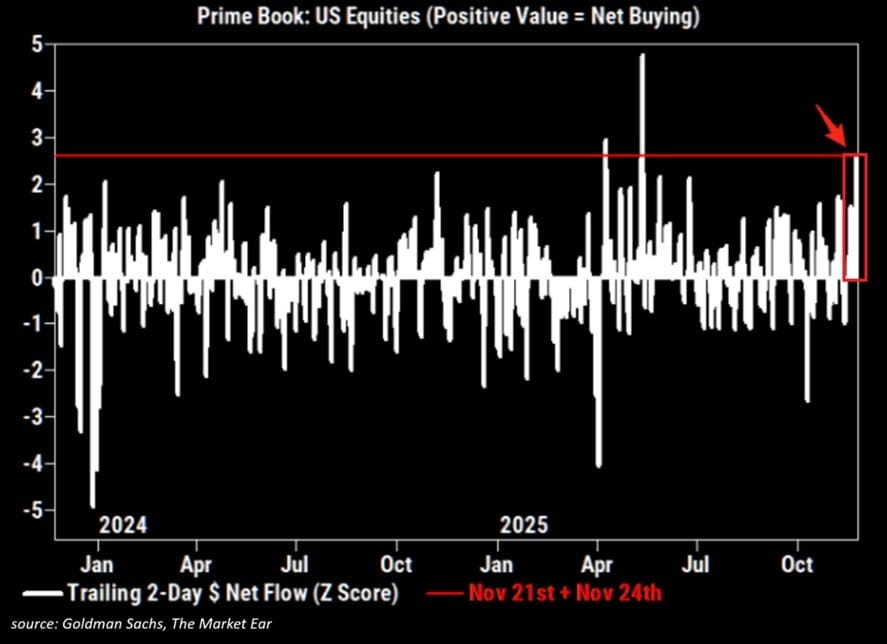

Between November 21 and 24, hedge funds didn’t blink. They recorded their largest two-day net equity buying spree since May, scooping up stock like it was 2020 all over again.

Single-name equities took 56% of the flows. ETFs and futures grabbed the remaining 44%. The big buyers went straight into semiconductors, hardware, and comms equipment, the same sectors that just caught a $250B body blow from Google’s new chip.

Call it dip buying if you want. Hedge funds called it a bulk discount with express checkout.

MEME OF THE DAY

News

Anything else on the burner?

NatWest Puts Cushon on the Block, Looks Like WTW Might Buy More Than Just Pensions

Gold might be limbering up again after investors briefly headed for the exits, according to KobeissiLetter

Starbucks Workers Go Grande on Strikes, Just in Time for Holiday Rush

New Epstein island photos just dropped via House Democrats. Nothing like a midweek plot twist from Congress.

Anduril’s Drones Took Off, Then Took a Break Mid-Air

Pentagon Considers Adding Alibaba, Baidu, BYD to Military List

Takeaway

Capital moves with conviction now. It finds the biggest names and keeps feeding them. Smaller names drift into oblivion. Traders chase speed, liquidity, and narrative density. Everyone else gets edited out of the tape.

Companies feel it. There’s pressure to launch before marketing is ready, to ship before the quarter closes, and to stay on the earnings call just long enough to say “AI” three times.

This cycle rewards execution, scale, and attention. Anyone who slows down ends up invisible. Motion creates memory and everything else gets scrolled past.